Data-Driven Venture Capital: use the levers of data with Invyo

Invyo revolutionizes venture capital with a unique data-driven approach. Our sector expertise, combined with AI, facilitates the identification of investment opportunities, the enrichment of dealflow and the detection of new LPs, thus optimizing our customers' strategic decisions.

Our fields of action

for your fund

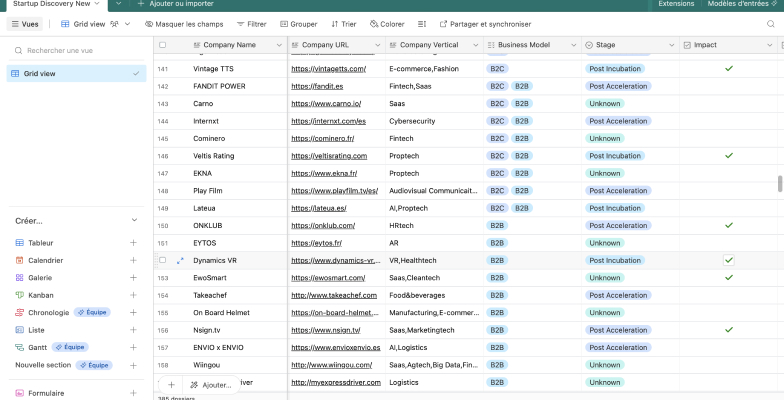

Deal sourcing

We aggregate all your internal data (CRM, M&A databases, etc.) and enrich your dealflow with alternative sources (LinkedIn, Pitchbook, Crunchbase, etc.) to map all the companies present in your target sectors.

Deal scoring

We enrich your dealflow with alternative data to detect market signals on your target companies such as :

- The founding score,

- Team growth,

- The fundraising score,

- Etc.

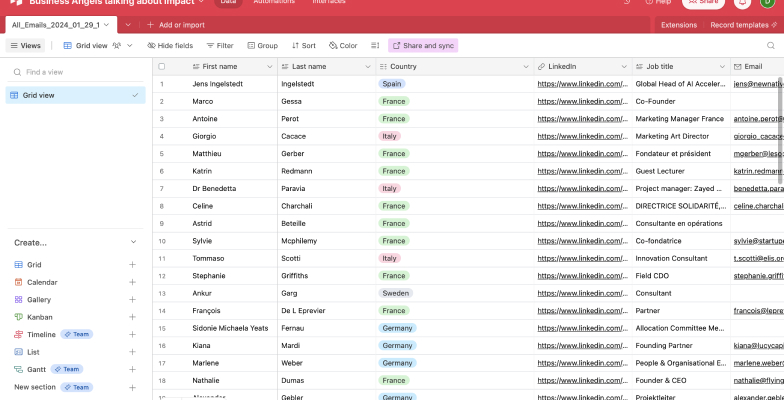

Search for LPs

We help funds and club deals identify new LPs in a variety of thematic and geographic verticals:

- Business Angels in Germany,

- Single Family Office in France,

- Corporate in sports, etc.

Our system also makes it easy to get in touch with identified LPs, via email or LinkedIn.

Any other requests?

Contact us to discuss your data needs.

Where do we get our data?

This list is not exhaustive and may vary according to your needs.

Databases

- Pitchbook

- Glassdoor

- SourceScrub

- Tracxn

- Dealroom

- Github

- Producthunt

- Pappers

- G2

- Similarweb

Social networking

- TikTok

- Google Reviews

- AppStores

Other

- Internal tools (CRM)

- Excel files

- Image

Our customers have their say

Invyo has revolutionized our search for LPs. In just a few minutes, their solution analyzes LinkedIn and identifies qualified contacts, turning hours of work into a fast, reliable task. This allows us to concentrate on higher value-added activities. The reliability rate is 100%, a remarkable saving in time and efficiency for our fund.

Candice BAUDET

Managing Partner at Accurafy4

Data is at the heart of our business as VCs, and we know that a good command of it will represent a definite competitive advantage in the future. Thanks to Invyo's teams, we have developed a powerful dealflow qualification tool that uses a scoring system to identify the most relevant companies in line with our deep tech investment thesis.

Etienne MOREAU

DeepTech Partner at Supernova Invest

While we've been developing our tech platform for 3 years at Red River West, we came across some use cases that were complicated to maintain and not worth developing in-house, so we quickly turned to Invyo. Indeed, their technical expertise and deep understanding of our business quickly convinced us that they were the best European player capable of developing tech solutions for Venture Capital.

Abel SAMOT

VC & Tech platform lead at Red River West

FAQ

How can data influence our venture capital investment decisions?

Data plays a crucial role in venture capital decision-making. It offers insights into financial viability, user traction and market trends, helping to assess startups' potential for success and minimize risk.

What types of data are most relevant to venture capitalists?

Venture capitalists rely on a variety of data such as growth metrics, customer retention, and startup revenue models. Sector data, industry trends and benchmarks are also valuable in assessing a company's competitiveness and sustainability.

What are the advantages of using data platforms for venture capitalists?

Data platforms offer efficient centralization and analysis of startup information. They enable real-time monitoring of performance, comparison between investment opportunities, and transparent collaboration between investment team members, leading to more informed and relevant decisions.

How can we integrate a data-driven approach into our venture capital investment strategy?

The successful integration of a data-driven approach requires specialized training, the adoption of appropriate technological tools, and the development of clear processes for collecting, analyzing and using data. An organizational culture focused on innovation, flexibility and responsiveness to data-driven insights also fosters an effective and adaptive venture capital investment strategy.

Talk to Alexandre about your project!

Let's analyze your fund's data-related issues together, and benefit from personalized support to meet your needs as effectively as possible.

Our resources