Use data to align your investments with your customers' convictions

Invyo is transforming family offices with an unprecedented data-driven approach. Our sector expertise, combined with AI, guides your customers in identifying investment targets, scoring financial assets according to ESG criteria, and much more.

Our fields of action

for your fund

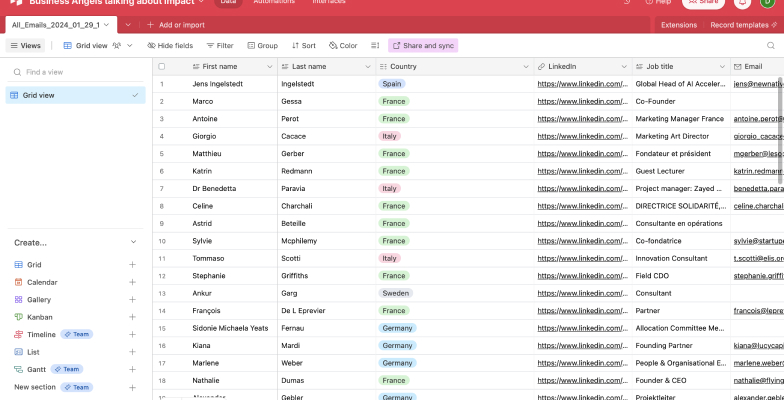

Family Officer 2.0

Forget Excel and switch to a modern solution to simplify data processing. Our data platform offers data analysis tools, leveraging AI and machine learning for efficient management of your customers' unlisted assets. Diversify data sources to invest in the best opportunities.

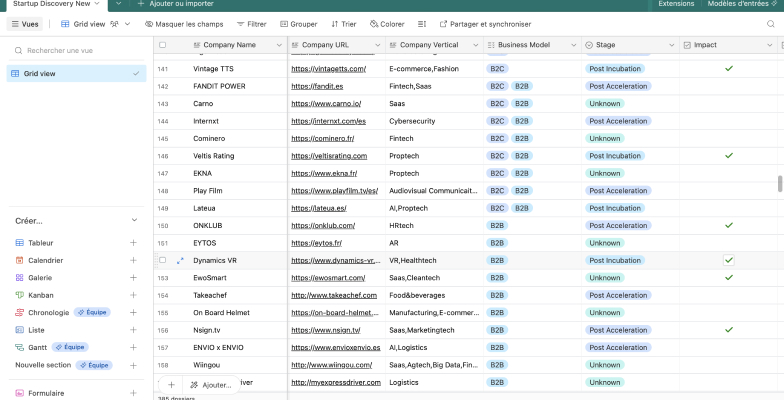

Deal sourcing & deal scoring

Offer your clients the chance to invest in the best investment opportunities on the market, thanks to our dealflow sourcing and scoring tools used by Europe's top tech funds.

Automatic reporting

Our solution offers efficient consolidation of financial data, enabling optimized management of your customers' assets. With Invyo, you benefit from a data platform focused on the needs of FOs and your customers, enabling the creation of automatic reporting and asset scoring based on impact/ESG criteria.

Where do we get our data?

This list is not exhaustive and may vary according to your needs.

Databases

- Pitchbook

- Glassdoor

- SourceScrub

- Tracxn

- Dealroom

- Github

- Producthunt

- Pappers

- G2

- Similarweb

Social networking

- TikTok

- Google Reviews

- AppStores

Other

- Internal tools (CRM)

- Excel files

- Image

FAQ

What are the advantages of using data for family offices?

The use of data offers several advantages to family offices. Firstly, it enables in-depth analysis of the investment portfolio and market trends, facilitating informed decision-making.

By harnessing data, Family Offices can also better understand their customers' needs and preferences, enabling them to personalize their services and improve customer satisfaction.

In addition, data analysis can help identify new investment opportunities, optimize risk management and improve overall family office performance.

How can data help family offices better understand their customers and meet their needs?

Data provides Family Offices with valuable insights into their customers' financial behavior and objectives. By analyzing transactional data, investment preferences and interactions with the family office, they can better understand their customers' expectations. This deeper understanding enables them to offer more personalized advice and solutions, strengthening customer relationships and long-term loyalty.

What are the best practices for collecting, storing and analyzing data within a family office?

Best practices for data management in a family office include setting up robust collection systems, securing sensitive data, and using high-performance analysis tools. It is essential to define clear processes for data collection, storage and maintenance, ensuring that they comply with current data protection regulations.

How can data security and confidentiality be guaranteed in a family wealth management context?

Data security and confidentiality are major concerns for family offices. To guarantee their protection, it is important to implement security measures such as data encryption, two-factor authentication and continuous monitoring for suspicious activity. In addition, it's essential to raise staff awareness of good IT security practices and to comply with current standards and regulations, such as the RGPD.

What are the key indicators and relevant analyses for assessing the performance of a family office using data?

To assess a family office's performance, several key indicators can be taken into account, such as overall portfolio performance, risk/return ratio, customer satisfaction and customer retention rate. By using advanced analytics, family offices can also assess the effectiveness of their investment strategies, identify market trends and anticipate their customers' future needs. By combining these indicators and analyses, Family Offices can assess their overall performance and take steps to optimize their results.

Talk to Alexandre about your project!

Let's analyze your fund's data-related issues together, and benefit from personalized support to meet your needs as effectively as possible.

Our resources