Private equity investors: opt for a data-driven strategy!

Invyo reinvents private equity with an innovative data-driven approach. Thanks to our sector expertise and artificial intelligence, we help our customers evaluate investment opportunities, automate valuation reports, identify C-level profiles, and much more.

Our fields of action

for your fund

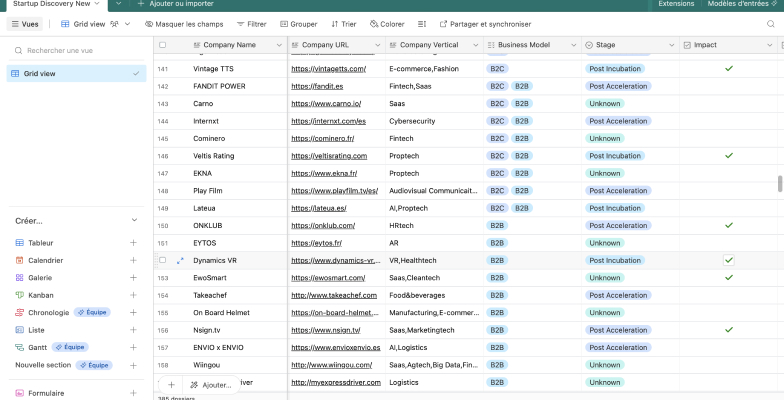

Deal monitoring

Our solutions enable you to stay abreast of market developments, thanks to active monitoring of indicators such as team growth, C-Level recruitment, takeovers, etc. With Invyo, always keep an eye on opportunities in your sector.

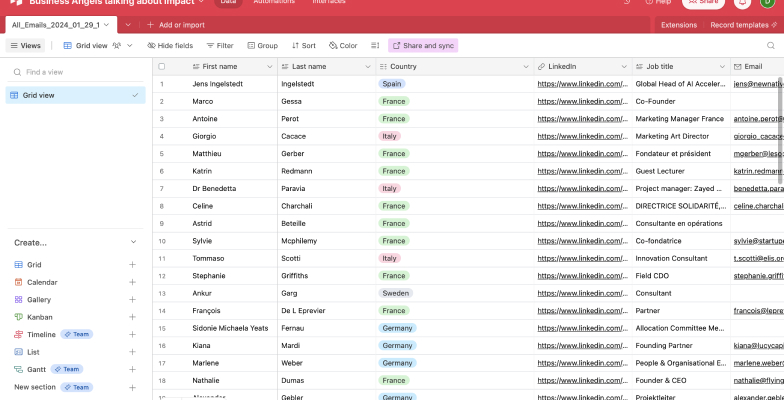

Data-driven support for your portfolio companies

We help funds to harness data for the benefit of their portfolio companies, by recruiting C-level profiles, putting them in touch with experts from the fund's network of partners, and so on.

Automatic reporting

Our solutions enable you to create comparative analysis notes between a target company and its competitors, to quickly see its positioning in relation to other players in the sector (e.g.: comparative analysis of a brand with its competitors on all social networks).

Any other requests?

Contact us to discuss your data needs.

Where do we get our data?

This list is not exhaustive and may vary according to your needs.

Databases

- Pitchbook

- Glassdoor

- SourceScrub

- Tracxn

- Dealroom

- Github

- Producthunt

- Pappers

- G2

- Similarweb

Social networking

- TikTok

- Google Reviews

- AppStores

Other

- Internal tools (CRM)

- Excel files

- Image

FAQ

What role does data play in private equity valuation and decision-making?

In private equity, data is of crucial importance for evaluating and deciding on investments. It provides an objective basis for assessing the target company's past and current performance, as well as for anticipating its future prospects. Financial, operational and sector data can be used to analyze the target company's financial health, operational management and market trends.

These data offer insights into the company's profitability, solvency, productivity and competitive position, helping investors to estimate its intrinsic value and assess the risks associated with the investment. By using relevant and reliable data, investors can make informed decisions, minimizing risks and maximizing value creation opportunities for all stakeholders involved.

In short, data plays a fundamental role in the private equity evaluation and decision-making process, guiding investors towards the most promising opportunities and the most effective investment strategies.

How can a data-driven strategy improve the performance and profitability of our investments?

A data-driven strategy improves investment performance and profitability by enabling in-depth analysis of financial, operational and sectoral data. It helps identify the most promising investment opportunities, assess potential risks and optimize resource allocation. By using reliable, relevant data, investors can make more informed decisions, reducing errors and maximizing returns.

What types of data are most relevant and useful for guiding our private equity decisions?

Financial data, operational indicators such as profitability and revenue growth, and sector data are crucial in guiding private equity decisions. Competitive data, market trends and past performance also help to assess the growth potential and risks associated with an investment.

What are the concrete benefits of using a data platform in our investment process?

The benefits of using a data platform include centralizing and structuring information, facilitating access to real-time analysis, comparison between different opportunities and collaboration between investment team members. It also reduces data processing times and improves forecasting accuracy.

How can we effectively integrate a data-driven approach into our existing private equity investment strategy?

To effectively integrate a data-driven approach, it is crucial to train staff in data analysis, invest in suitable technological tools, define clear processes for collecting, storing and interpreting data, and encourage a culture of innovation and collaboration within the organization.

Talk to Alexandre about your project!

Let's analyze your fund's data-related issues together, and benefit from personalized support to meet your needs as effectively as possible.

Our resources